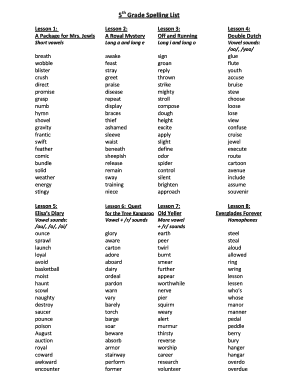

Get the free typically you'll need documents your identity and credit history

Show details

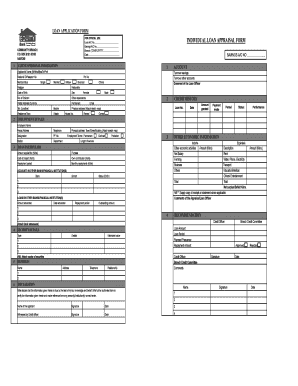

EQUILOAN APPLICATION FORM FOR TSC STAFF Branch Date of application Account NO loan Date opened Particulars of applicant Surname other names Date of Birth Date employed I. D No. TSC No. Station/School District Province Dept/code No Deduct code No EDS 861 Account Code EQBL office Address Office Tel No Home Tel No. Gross salary Net salary Please attach copy of ID and last 3 pay slips Details of loan Loan Amount plus interest Repayment period months Monthly repayments Kshs Purpose of loan...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how to approve loan on tpay form

Edit your is tpay open for loan approval form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your frequently asked questions about t pay tsc form text the loan approval process involves and can afford the loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tpay loan approval online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tsc loan approval portal form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how to fill out tsc loan approval 06 form

How to fill out tsc loan approval:

01

Gather all the required documents such as identification proofs, income statements, and any other supporting documents as requested by the loan application.

02

Carefully read through the loan application form, paying attention to all the fields that need to be filled out.

03

Provide accurate and up-to-date information in each field of the application form.

04

Double-check all the information provided before submitting the loan application to avoid any errors or inconsistencies.

05

Make sure to sign the application form where required.

06

Submit the completed loan application along with all the necessary documents to the designated authority or institution.

Who needs tsc loan approval:

01

Individuals who require financial assistance for personal purposes such as purchasing a home, car, or funding education.

02

Business owners seeking funding for their ventures or expansion plans.

03

Anyone who meets the eligibility criteria set by the loan provider and requires financial support for their specific needs.

Fill

tpay

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete tsc online payment online?

pdfFiller has made it easy to fill out and sign tsc loan approval. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for the is tpay open for loan approval tsc in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your intext ebsafrica intext equity bank login or verify or secure in minutes.

How can I fill out preparing your loan application packet visually accessible to the reviewer on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your how long does tsc take to approve a loan. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

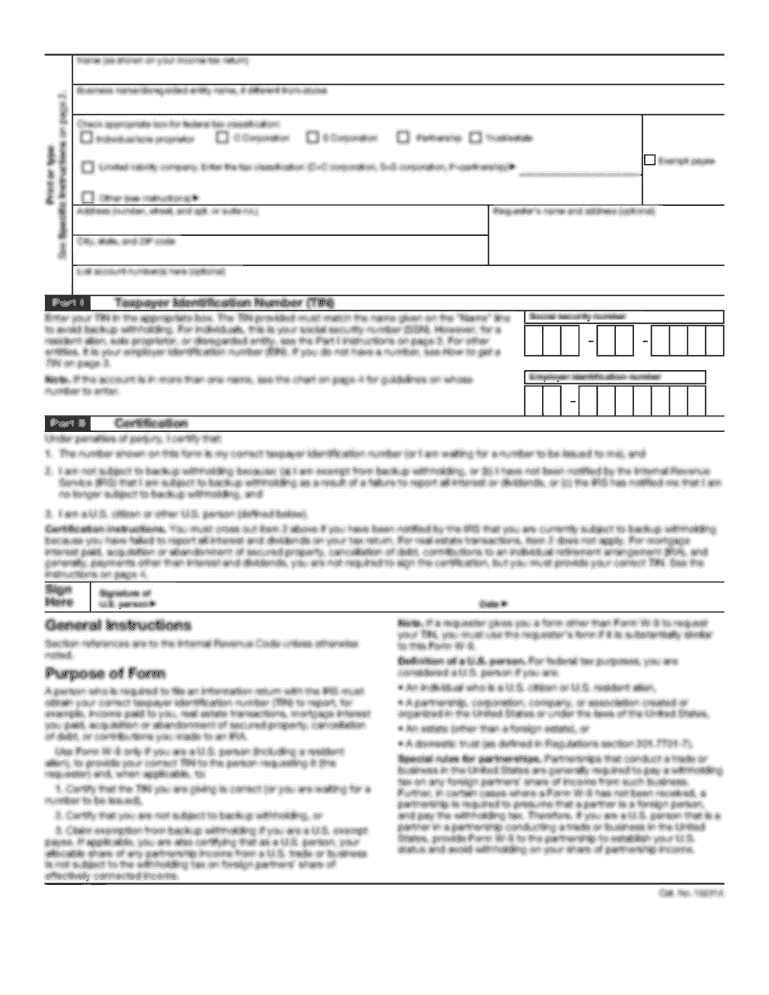

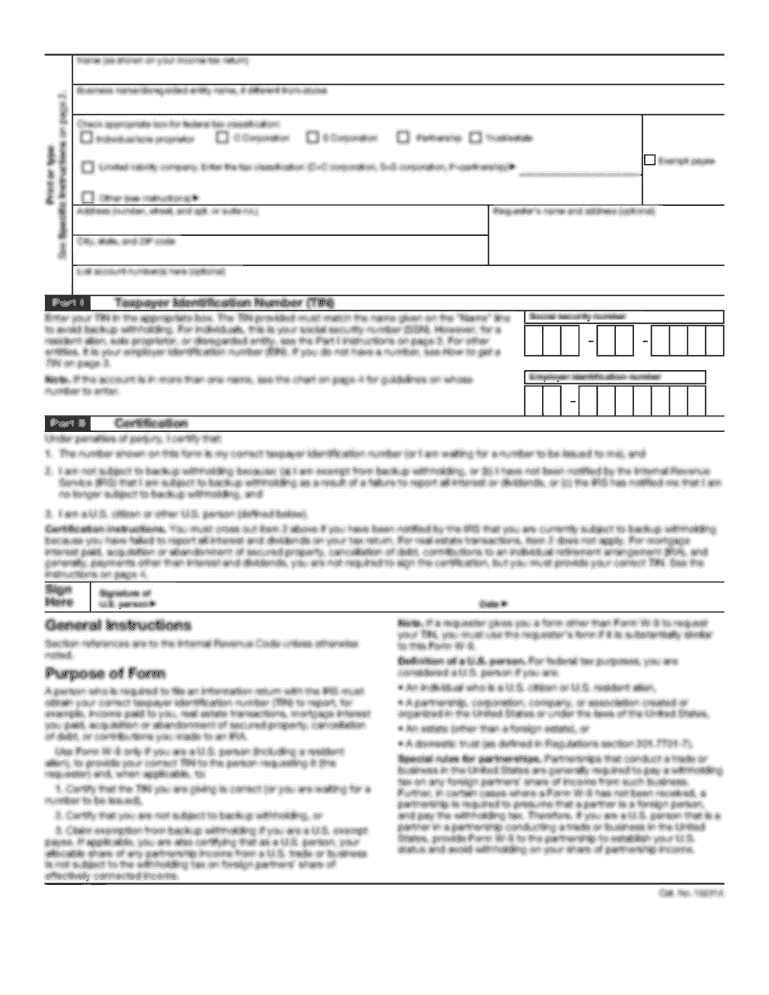

What is tpay?

Tpay refers to a specific document or form used in certain financial or tax reporting contexts, often related to payments or transaction reporting.

Who is required to file tpay?

Individuals or businesses who meet certain financial thresholds or engage in specific types of transactions as defined by tax authorities are required to file tpay.

How to fill out tpay?

To fill out tpay, one must provide personal or business information, transaction details, and any required supporting documentation as specified in the filing instructions.

What is the purpose of tpay?

The purpose of tpay is to ensure proper reporting of financial transactions to comply with tax regulations and to provide transparency in payment systems.

What information must be reported on tpay?

Information required on tpay typically includes the payer's and payee's details, the amount of the transaction, the type of transaction, and date of payment.

Fill out your typically youll need documents online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tsc Loan is not the form you're looking for?Search for another form here.

Keywords relevant to bajaj finserv

Related to how to approve loan on tpay tsc

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.